Online Shopping Budget: A Student’s Guide to Smart Spending

Online shopping budgeting for students involves setting financial limits and strategies to manage expenses, avoid debt, and make informed purchasing decisions while studying.

Navigating university life often means balancing studies with a budget that might feel stretched thin. Adding online shopping to the mix can either be a convenience or a quick route to debt if not managed wisely. This guide offers **online shopping budgeting for students: tips for managing limited funds and and avoid debt** , designed to keep your finances in check while you enjoy the perks of e-commerce.

Why Budgeting Matters for Students Online?

Understanding the importance of budgeting is the first step toward financial stability as a student. It’s not just about restricting spending, but more about making informed decisions that align with your financial goals and resources.

Earning and Spending Habits

Most students operate on a limited and often variable income, sourced from part-time jobs, student loans, or support from family. Budgeting helps track where your money goes and identifies opportunities for savings.

- Track Expenses: Use budgeting apps or spreadsheets to monitor spending.

- Identify Leaks: Spot areas where you’re overspending, like impulse buys.

- Set Priorities: Allocate funds for essentials before non-essentials.

The core of successful online shopping budgeting lies in recognizing your earning potential and matching it with your spending habits.

Creating a Realistic Shopping Budget

Crafting a realistic budget requires an honest assessment of your income and expenses. Being realistic means not underestimating your spending or overestimating your income.

Assessing Income and Expenses

Start by listing all sources of income (e.g., wages, allowances) and then catalog your monthly expenses (e.g., tuition, rent, food). Factor in recurring costs like subscriptions and occasional splurges.

Calculate the difference between income and expenses to understand how much you have available for discretionary spending, including online shopping.

Allocating Funds for Various Needs and Wants

Allocate funds based on priorities. Necessities, such as textbooks and groceries, should come first, followed by personal needs like clothing and entertainment. Set a specific limit for online shopping within your “wants” category.

This strategic approach ensures that you meet essential obligations while still enjoying the flexibility of online shopping, all without accumulating debt.

Practical Tips for Saving Money While Shopping Online

Saving money while shopping online involves more than just finding the cheapest price. It requires a comprehensive approach that considers the entire shopping process, from planning to purchase.

Comparison Shopping and Price Tracking

Before making any purchase, compare prices across multiple retailers. Use browser extensions or websites that automatically track price changes and alert you to deals.

Utilizing these tools helps ensure you’re always getting the best possible price, regardless of when or where you shop.

Utilizing Student Discounts and Coupons

Always look for student discounts. Many retailers offer exclusive deals for students with a valid student ID. Additionally, search for online coupons and promo codes before finalizing your purchase.

- Check Student Websites: Sites like UNiDAYS and Student Beans compile discounts.

- Sign Up for Newsletters: Retailers often send exclusive offers to subscribers.

- Use Browser Extensions: Extensions like Honey automatically find and apply coupons.

These small savings can add up, allowing you to maximize your limited budget and make more purchases without overspending.

Avoiding Impulse Buys and Overspending

Impulse buying is a significant challenge for many online shoppers, leading to overspending and potential debt. Developing strategies to curb impulsive behavior is crucial for maintaining a healthy budget.

Strategies to Avoid Impulse Purchases

Create a waiting period before making non-essential purchases. If you still want the item after 24-48 hours, it’s more likely a considered purchase than an impulse.

Also, avoid shopping when you’re bored or stressed, as emotional states can cloud your judgment.

Setting Spending Limits and Using Wish Lists

Implement spending limits for each shopping session or month to keep your expenses in check. Use wish lists to store items you’re interested in without immediately buying them.

This practice allows you to evaluate your needs and wants more objectively, reducing the likelihood of impulsive purchases that can derail your budget.

Understanding Credit and Avoiding Debt

Managing credit wisely is an essential skill for students, especially those who shop online. Misusing credit cards can lead to high interest rates and mounting debt, which can be particularly challenging to manage on a student’s budget.

Responsible Credit Card Use

If you have a credit card, use it responsibly. Always pay your balance in full each month to avoid interest charges. Understand your credit limit and try to keep your spending below 30% of the limit to maintain a good credit score.

This responsible approach helps build a positive credit history, which can be beneficial for future loans and financial opportunities.

Alternatives to Credit Cards

Consider using debit cards or prepaid cards for online shopping to avoid the risk of accumulating debt. These options ensure you only spend what you have available, preventing unexpected charges and interest fees.

Using these alternatives promotes disciplined spending habits and financial stability, which are vital for students navigating the complexities of budgeting and online shopping.

Tools and Apps for Budgeting

Leveraging budgeting tools and apps can make it easier to track your spending, set financial goals, and stay within your budget. These resources provide real-time insights into your finances, helping you make informed decisions.

Overview of Available Budgeting Apps

Explore popular budgeting apps like Mint, YNAB (You Need a Budget), and Personal Capital. These apps offer features such as expense tracking, budget creation, and financial goal setting.

Each app has its unique strengths, so try a few to find one that fits your needs and preferences.

Using Spreadsheets for Budget Tracking

If you prefer a more hands-on approach, create a spreadsheet using programs like Microsoft Excel or Google Sheets. Customize your spreadsheet to track income, expenses, and savings goals.

- Automate Calculations: Use formulas to automatically calculate totals and balances.

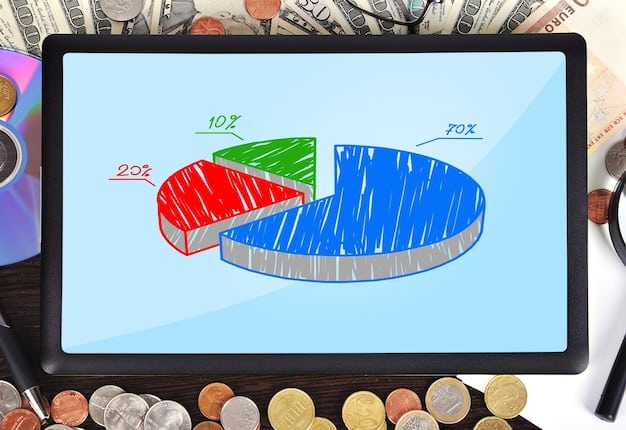

- Visualize Data: Create charts to visualize your spending patterns.

- Regular Updates: Update your spreadsheet regularly to maintain accuracy.

Whether you choose a budgeting app or a spreadsheet, the key is to consistently track your spending and adjust your habits as needed to stay on track.

| Key Point | Brief Description |

|---|---|

| 💰 Track Expenses | Monitor spending to identify where your money goes. |

| 🛒 Avoid Impulse Buys | Wait before buying non-essentials to reduce impulsive purchases. |

| 💯Use Student Discounts | Take advantage of student discounts and coupons to save money. |

| 💳 Responsible Credit Use | Pay credit card balances in full to avoid interest and debt. |

Frequently Asked Questions (FAQ)

▼

Use budgeting apps like Mint or YNAB to automatically track your online purchases. Alternatively, create a spreadsheet to manually log each transaction. The key is consistency.

▼

Review your budget to identify areas where you can cut back spending in other categories. Avoid making any non-essential purchases for the remainder of the month to reset your spending habits.

▼

Yes, absolutely. Student discounts can offer significant savings, especially on textbooks, software, and clothing. Consistently checking for these discounts can save you a substantial amount over time.

▼

Find alternative stress-relief activities, such as exercise, meditation, or spending time with friends. Avoid browsing online shopping sites when you’re feeling stressed or bored to minimize impulsive purchases.

▼

Consider using debit cards or prepaid cards. These options prevent you from spending more than you have and help avoid debt. Another option is using payment platforms like PayPal with your bank account linked.

Conclusion

Effectively managing an online shopping budget as a student involves a combination of careful planning, diligent tracking, and responsible spending habits. By implementing the strategies discussed, students can enjoy the convenience of online shopping without jeopardizing their financial stability.