Mastering the 50/30/20 Rule for Online Shopping in 2025

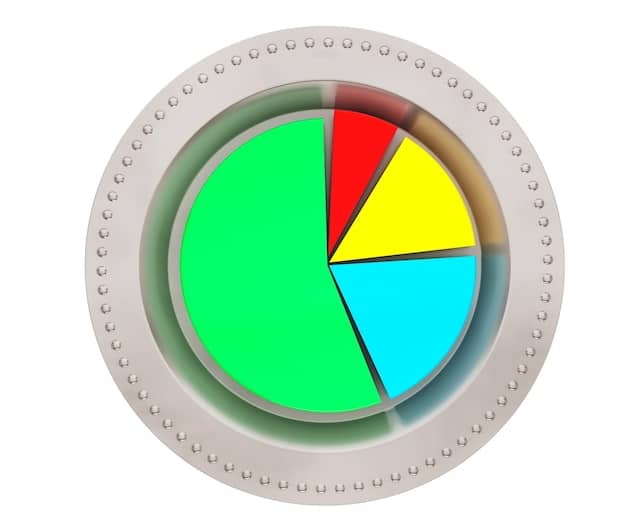

Mastering the 50/30/20 rule for online shopping in 2025 involves allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment, enabling informed spending decisions and financial stability in the digital marketplace for US consumers.

Navigating the world of online shopping can be overwhelming, but implementing a structured budget can bring clarity and control. The Mastering the 50/30/20 Rule for Online Shopping: A US Budgeting Guide for 2025 offers a practical framework for managing your finances effectively in the digital age.

Understanding the 50/30/20 Rule

The 50/30/20 rule is a straightforward budgeting method that divides your after-tax income into three categories: needs, wants, and savings/debt repayment. Understanding this rule is the first step towards effective financial management.

By allocating your income in this way, you can ensure that your essential expenses are covered while still having room for discretionary spending and financial goals.

Defining Needs, Wants, and Savings

Distinguishing between needs, wants, and savings is crucial for applying the 50/30/20 rule effectively. Let’s explore each category in more detail:

- Needs: These are essential expenses necessary for survival and daily living, such as housing, food, transportation, and healthcare.

- Wants: These are non-essential expenses that enhance your lifestyle but aren’t crucial for survival, like dining out, entertainment, and brand-name clothing.

- Savings/Debt Repayment: This category includes saving for future goals, such as retirement or a down payment on a house, as well as paying off any outstanding debts.

Identifying the right balance ensures financial stability and progress towards your long-term goals.

In summary, understanding the 50/30/20 rule involves knowing what falls into each category, allowing you to allocate your income appropriately.

Applying the 50/30/20 Rule to Online Shopping

Applying the 50/30/20 rule to online shopping requires careful planning and self-awareness. This section will provide strategies to integrate this budgeting method into your online spending habits.

By being mindful of your purchases and sticking to your budget, you can enjoy the convenience of online shopping without compromising your financial health.

Strategies for Needs, Wants, and Savings Online

Implementing the 50/30/20 rule online involves specific strategies for each category:

- Needs (50%): Prioritize essential purchases such as groceries, household supplies, and necessary subscriptions. Compare prices and look for discounts to maximize your budget.

- Wants (30%): Allocate a portion of your budget to discretionary online purchases like clothing, electronics, or entertainment. Set limits for each type of item to avoid overspending.

- Savings/Debt Repayment (20%): Automatically transfer a percentage of your online spending budget to savings or debt repayment accounts. This ensures consistent progress toward your financial goals.

These strategies will help you effectively manage your online spending within the framework of the 50/30/20 rule.

Ultimately, effective online budgeting involves segmenting your spending into needs, wants, and savings, and sticking to predefined limits.

Tracking Your Online Spending

Tracking your online spending is essential for adhering to the 50/30/20 rule. Without accurate tracking, it’s easy to lose sight of where your money is going and exceed your budget.

Effective tracking provides the insights needed to make informed decisions and adjust your spending habits.

Tools and Apps for Tracking

Numerous tools and apps can help you track your online spending efficiently:

- Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital allow you to categorize and monitor your spending across various accounts.

- Spreadsheets: Creating a simple spreadsheet to log your purchases and categorize them under needs, wants, and savings can provide a clear overview of your spending patterns.

- Bank Statements: Regularly reviewing your bank statements can help you identify areas where you may be overspending and make necessary adjustments.

Using these tools will enable you to monitor your spending and stay within your allotted budget.

Regular tracking provides visibility and ensures adherence to the 50/30/20 rule for online shopping.

Adjusting the 50/30/20 Rule for Individual Circumstances

While the 50/30/20 rule provides a solid foundation, it’s important to adjust it based on your individual circumstances and financial goals. Flexibility is key to making the rule work for you.

Your income level, debt obligations, and personal preferences can all influence how you allocate your resources.

Factors to Consider

Several factors may necessitate adjusting the standard 50/30/20 rule:

- Income Level: If you have a lower income, you may need to allocate a higher percentage to needs and reduce the amounts for wants and savings.

- Debt Obligations: If you have significant debt, you may need to allocate a higher percentage to debt repayment to become debt-free faster.

- Financial Goals: If you have specific savings goals, such as buying a home or investing, you may need to allocate a higher percentage to savings.

Considering these factors will ensure that your budget aligns with your priorities.

Adapting the rule to fit personal circumstances enhances its effectiveness and supports long-term financial health.

Common Pitfalls to Avoid

Even with a well-structured budget, it’s easy to fall into common pitfalls when shopping online. Being aware of these pitfalls can help you avoid them.

Awareness and proactive strategies are crucial to maintaining budgetary discipline.

Impulse Buying and Overspending

Impulse buying and overspending are common challenges when shopping online. Here are some strategies to avoid them:

- Set a Budget: Determine how much you can spend before you start shopping.

- Make a List: Stick to a predefined list to avoid unplanned purchases.

- Avoid Temptation: Unsubscribe from promotional emails and avoid browsing shopping websites when you’re bored or stressed.

By avoiding these pitfalls, you can stay on track and achieve your financial goals.

Mitigating these risks ensures that you stay within your financial limits.

Future Trends in Online Shopping and Budgeting (2025)

The landscape of online shopping is constantly evolving, and staying informed about future trends is crucial for effective budgeting in 2025. New technologies and consumer behaviors will shape the way we spend and manage our money online.

Staying ahead of these trends will enable you to adapt and refine your budgeting strategies.

AI and Personalized Budgeting

In 2025, Artificial Intelligence (AI) is expected to play an increasingly significant role in personalized budgeting. AI-powered tools can analyze your spending patterns, provide customized budget recommendations, and automate savings. This will make it easier to adhere to the 50/30/20 rule and achieve your financial goals.

Embracing these technological advancements can enhance your ability to manage your finances effectively.

AI-driven personalization is set to redefine online shopping and budgeting, increasing efficiency and control.

| Key Point | Brief Description |

|---|---|

| 💰 Rule Basics | Allocate 50% to needs, 30% to wants, and 20% to savings/debt. |

| 🛒 Online Shopping | Apply the rule to online purchases by categorizing spending. |

| 📊 Tracking Tools | Use apps or spreadsheets to monitor online spending habits. |

| 🤖 Future Trends | AI-driven tools will personalize and automate budgeting. |

Frequently Asked Questions

▼

Needs include essential expenses required for survival, such as housing, groceries, transportation, healthcare, and necessary utilities. These are non-negotiable costs you must cover to maintain a basic standard of living.

▼

If your income varies, calculate your budget based on your average monthly income over the past few months. During higher-income months, allocate the surplus to savings or debt repayment to compensate for lower-income months.

▼

To reduce “wants” spending, try setting a waiting period before making non-essential purchases, unsubscribing from promotional emails, and finding free or low-cost alternatives for entertainment and leisure activities.

▼

It’s recommended to review and adjust your budget at least once a month to ensure it aligns with your current financial situation. Make adjustments based on changes in income, expenses, or financial goals.

▼

Yes, the 50/30/20 rule can still be applied with irregular income. Calculate your budget based on your monthly average income. Set aside a buffer in savings to cover needs during lower-income months, maintaining financial stability.

Conclusion

In conclusion, mastering the 50/30/20 rule for online shopping involves understanding your income, categorizing your expenses, tracking your spending, and adapting the rule to fit your unique circumstances. By implementing these strategies, you can achieve financial stability, make informed spending decisions, and enjoy the convenience of online shopping without compromising your long-term financial goals.