The Ultimate Guide to Smart Online Shopping Budgeting

The key to successful online shopping on a budget lies in planning, comparing and utilizing available tools to maximize savings while avoiding impulse purchases and hidden fees.

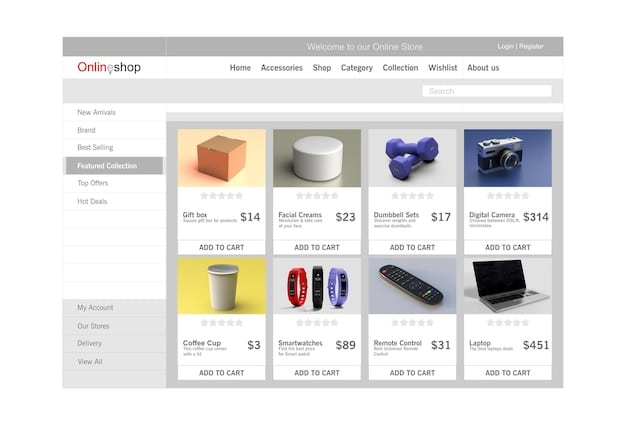

Navigating the vast world of online shopping can be both exciting and overwhelming, especially when trying to stick to a budget. The challenge lies in finding the perfect balance between desire and financial responsibility. Let’s explore some effective strategies to make the most of your online shopping while staying within budget.

Mastering the Basics of Online Budgeting

Before diving into the specifics, it’s essential to understand the fundamental principles of budgeting for online shopping. This involves setting clear financial goals, tracking expenses, and understanding where your money is going.

Setting Realistic Financial Goals

Start by defining what you want to achieve with your shopping budget. Are you saving for a specific item, trying to reduce overall spending, or just looking to avoid debt?

- Establish specific and measurable goals.

- Set a limit for what you are willing to spend. Do not overspend!

- Focus on priorities and consider your financial circumstances.

Tracking Your Spending Habits

Knowing where your money goes is crucial for effective budgeting. Monitoring your online shopping habits can reveal patterns and areas where you can cut back.

In conclusion, mastering the basics requires a clear understanding of your financial goals and spending habits. Through careful tracking and planning, you can create a sustainable online shopping budget.

Leveraging Price Comparison Tools

One of the most effective ways to save money while shopping online is to use price comparison tools. These tools allow you to quickly compare prices from different retailers, ensuring you get the best deal possible.

Benefits of Price Comparison Websites

Price comparison websites aggregate prices from numerous retailers, giving you a broad overview of available prices.

- Quickly identify the lowest prices for the same product.

- Save time by avoiding manual browsing of multiple websites.

- Discover potential deals and discounts you might otherwise miss.

Popular Price Comparison Tools

Several websites and browser extensions can help you compare prices effortlessly. Some popular options include:

- Google Shopping: A comprehensive tool that aggregates prices from various retailers.

- ShopSavvy: A mobile app that allows you to scan barcodes and compare prices in real-time.

- CamelCamelCamel: A tool specifically for tracking prices on Amazon.

By utilizing price comparison tools, you can ensure that you are always getting the best deals available. This simple yet effective strategy can lead to significant savings overall.

Utilizing Coupons and Discount Codes

Coupons and discount codes are another essential tool for budget-conscious online shoppers. These codes can provide significant savings, but finding them can be time-consuming.

Where to Find Coupons and Discount Codes

Numerous websites and browser extensions are dedicated to finding and sharing coupons and discount codes. Some popular sources include:

- RetailMeNot: A comprehensive website with a vast database of coupons and promo codes.

- Honey: A browser extension that automatically finds and applies available coupon codes at checkout.

- Coupons.com: A reliable source for printable coupons and online promo codes.

Strategies for Maximizing Savings

To make the most of coupons and discount codes, consider the following strategies:

- Combine coupons with sales and promotions.

- Sign up for email newsletters to receive exclusive discounts.

- Check for codes before completing every purchase.

In summary, strategically using coupons and discount codes can significantly reduce your online shopping expenses. With a little effort, you can save a considerable amount of money on your purchases.

Avoiding Impulse Purchases

Impulse purchases can quickly derail your budget. Learning to resist the temptation to buy things you don’t need is crucial for maintaining financial discipline.

Identifying Triggers for Impulse Buying

Understanding what triggers your impulse purchases is the first step in preventing them. Common triggers include:

- Emotional states: Feeling stressed, bored, or excited.

- Marketing tactics: Limited-time offers, flash sales, and enticing ads.

- Social influence: Seeing friends or influencers promote products.

Strategies to Resist Temptation

Once you’ve identified your triggers, you can implement strategies to resist the urge to buy impulsively:

- Wait 24 hours before making a non-essential purchase.

- Unsubscribe from promotional emails and social media ads.

- Create a shopping list and stick to it.

By recognizing and addressing your triggers, you can significantly reduce the number of impulse purchases you make. This will help you stay on track with your budget and achieve your financial goals.

Understanding Shipping Costs and Return Policies

Hidden fees and restrictive return policies can significantly impact your budget. Being aware of these factors can help you avoid unexpected costs and make informed purchasing decisions.

Evaluating Shipping Costs

Shipping costs can vary widely between retailers. Consider the following when evaluating shipping options:

- Look for free shipping thresholds.

- Compare shipping costs between different retailers.

- Consider using a shipping consolidator if you frequently order from multiple sources.

Understanding Return Policies

A clear understanding of return policies is essential to avoid being stuck with unwanted items.

- Check the retailer’s return policy before making a purchase.

- Note the return window and any associated fees.

- Keep all original packaging and receipts.

Understanding shipping costs and return policies ensures that you are not caught off guard by unexpected expenses. Careful planning and attention to detail can save you money.

Using Cashback Programs and Rewards Credit Cards

Cashback programs and rewards credit cards can provide additional savings on your online purchases. These programs offer rebates and rewards points that can be redeemed for cash or other benefits.

Exploring Cashback Programs

Cashback programs give you a percentage of your purchase back as cash. Consider the following options:

- Rakuten: A popular cashback website that partners with numerous retailers.

- Ibotta: An app that offers cashback on grocery and household items.

- TopCashback: A cashback website that offers competitive rates.

Choosing a Rewards Credit Card

Rewards credit cards can also help you save money on online purchases. Look for cards that offer cashback, points, or miles on your spending.

- Compare the rewards rates and redemption options of different cards.

- Consider the annual fee and other associated costs.

- Ensure you can pay off the balance each month to avoid interest charges.

In conclusion, leveraging cashback programs and rewards credit cards offers additional avenues for saving money on your online purchases. Strategically using these tools can help you maximize your savings.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting Basics | Set financial goals and track expenses to manage spending. |

| 🏷️ Price Comparison | Use tools to compare prices and ensure you get the best deals. |

| 🎫 Coupons and Discounts | Find and use coupons for extra savings on purchases. |

| 💳 Cashback and Rewards | Utilize programs and credit cards to earn rewards on spending. |

Frequently Asked Questions (FAQ)

▼

Begin by setting a monthly spending limit specifically for online purchases. Track your current spending to understand your habits, then adjust the limit as needed.

▼

Popular choices include Google Shopping, ShopSavvy, and CamelCamelCamel. These tools help you quickly compare prices from various online retailers.

▼

Check websites like RetailMeNot and Coupons.com. Additionally, browser extensions like Honey can automatically find and apply coupon codes at checkout.

▼

Implement a 24-hour waiting period before buying non-essential items. Unsubscribe from promotional emails to reduce temptation and create a strict shopping list.

▼

Seek cards with high cashback rates, low annual fees, and rewards that align with your spending habits. Ensure you can pay off the balance monthly to avoid interest fees.

Conclusion

By following these strategies, you can effectively manage your online shopping budget, making informed purchasing decisions and minimizing unnecessary expenses. The key is to be proactive and disciplined in your approach to achieve your financial goals.